Market Insight By Craig Madill

Click here if you would like to be added to the Market Insight distribution list.

Feb 16th 2023

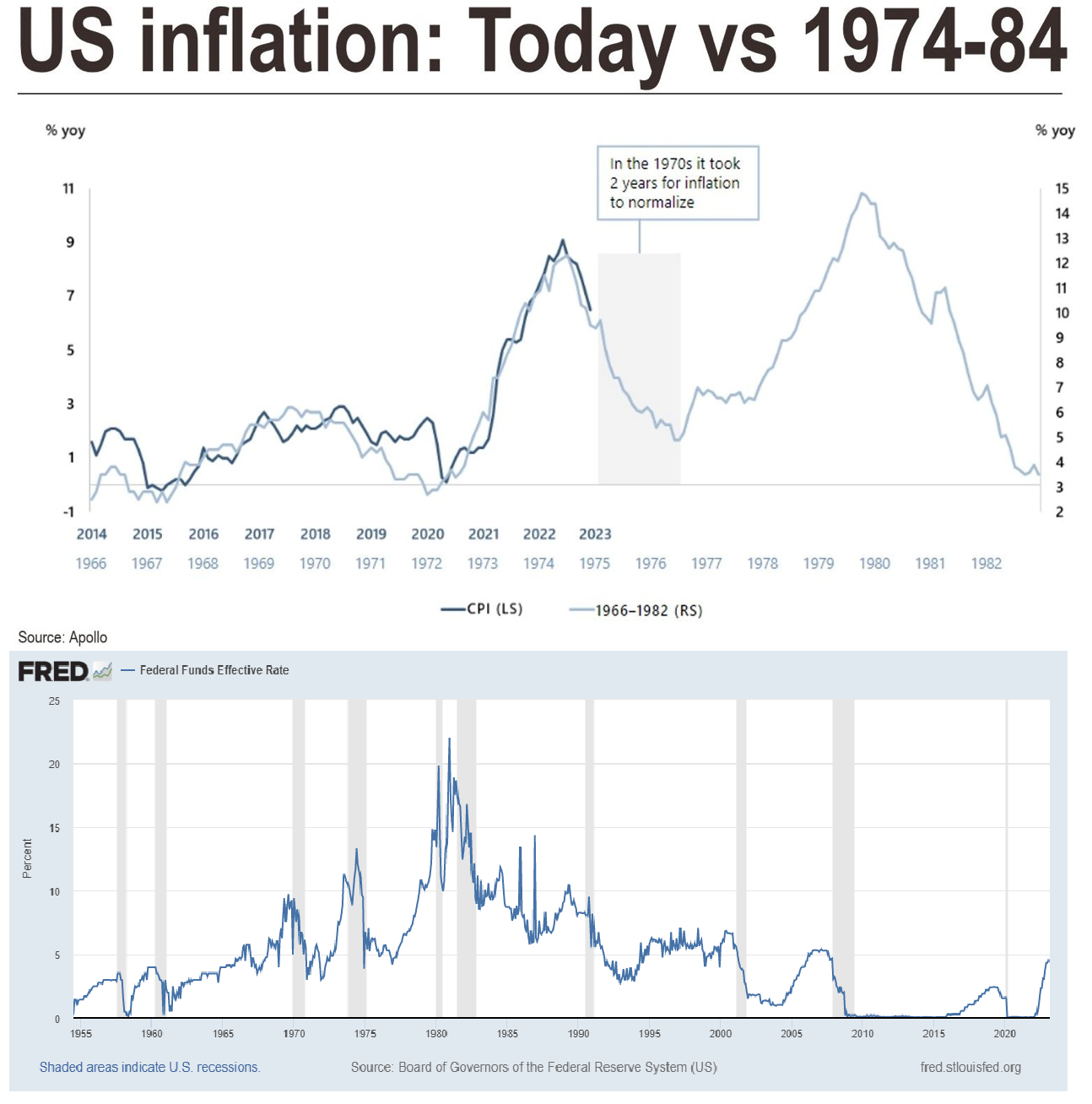

What’s keeping central bankers up at night and likely why higher rates may stick around for a bit? In 1973-1975 we saw a ramp up in inflation, oil prices, higher interest rates, recession, and then lower rates (Chart 1 & 2). As we entered recession in 1975 interest rates moved lower to stimulate the economy (back to pre-inflation levels, Chart 2). By the late 70’s inflation began to ramp up again, and with a spike in oil prices we saw inflation and interest rates move higher than the previous highs in 1975. Central bankers know this playbook and would rather raise rates too much or keep them higher for longer to avoid this resurgence of inflation outcome.

(Similar but not the same. There were many forces that caused the inflation run up in the 1980’s, including a huge demand driven by the baby-boom population entering the workforce and household formation)

Feb 9th 2023

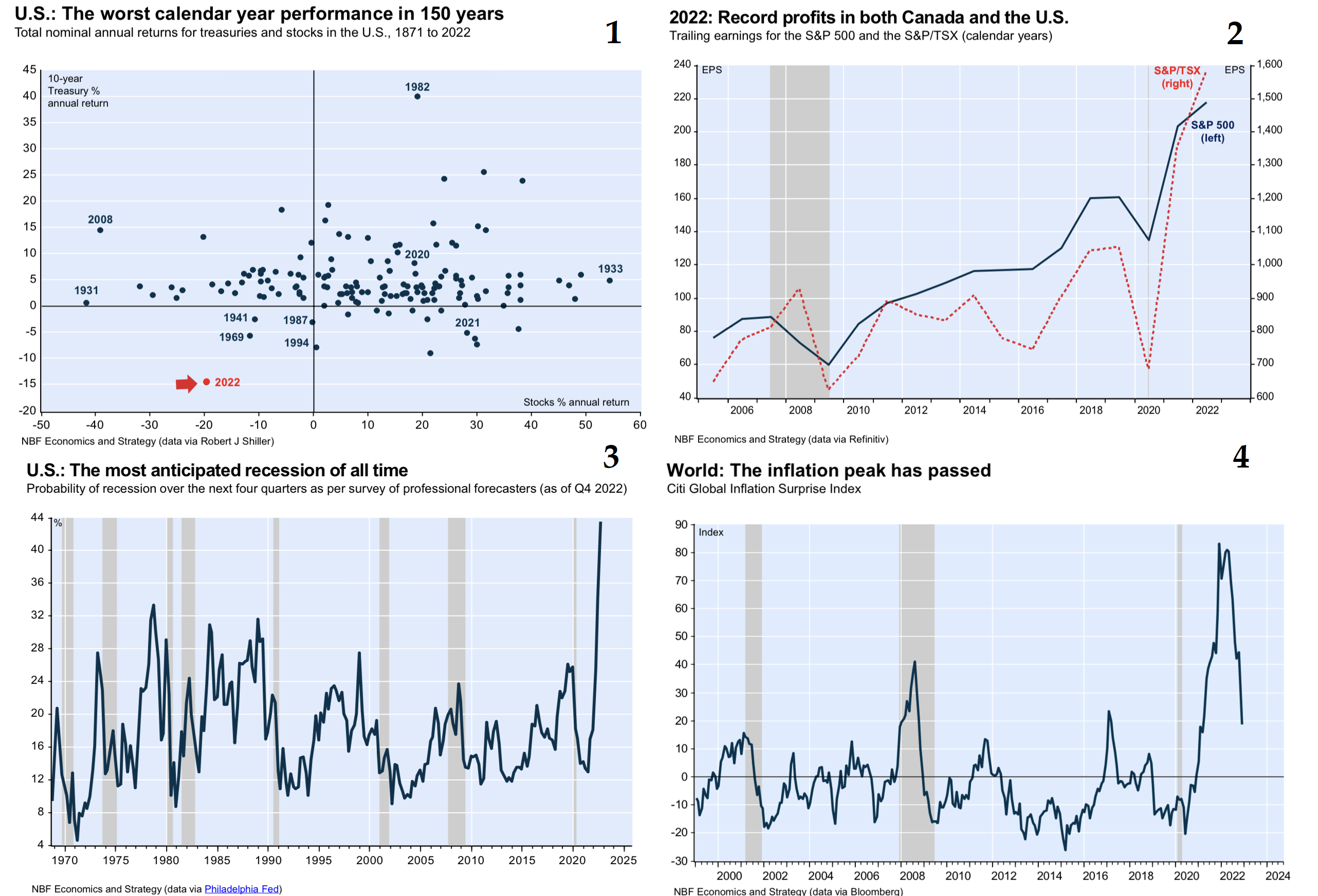

2022 marked the worst performance in stocks and bonds in 150 years (Chart 1). It’s important to note that corporate earnings in the TSX and S&P500 actually rose to record highs in 2022 (Chart 2). So, the poor performance in the markets was not from a decline in earnings, but from investors’ expectations of future declines and from pricing in most anticipated recession of all time (Chart 3). Economists and strategist are far from perfect, many positive catalysts can delay or soften a pending recession, including inflation falling faster than expected and de-escalating global tensions (Chart 4).

Feb 1st 2023

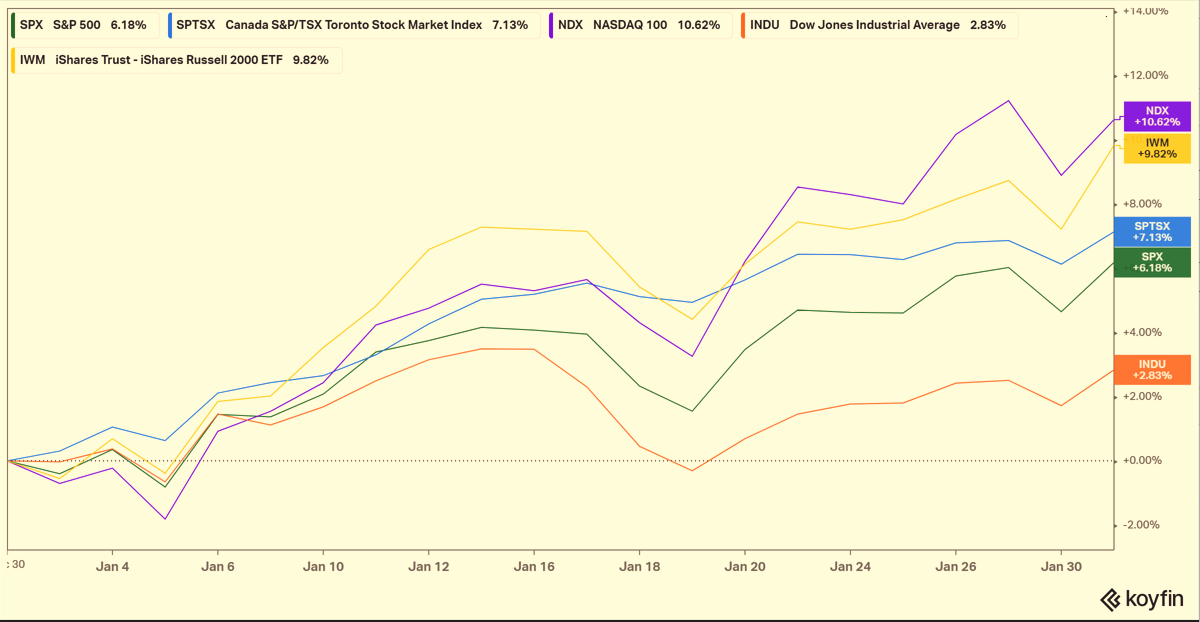

In the month of January the TSX was up 7.1%, the S&P 500 gained 6.2%, and the NASDAQ was up +10%. For what it’s worth, historically anytime the S&P has been positive for the month of January the market closed higher for the full year 86% of the time, with a median gain of +16%. And in years that January was positive after a negative year proceeding it (ex 2022 down 18%), then the full year has been positive 100% of the time, with a median gain of +20%. Given how bearish sentiment began in 2023, it’s not surprising to see a snap back higher. We still have inflation, higher rates from central banks, and a potential recession to combat. But the historical odds are in the bulls favor, and we are off to a good start for the year.

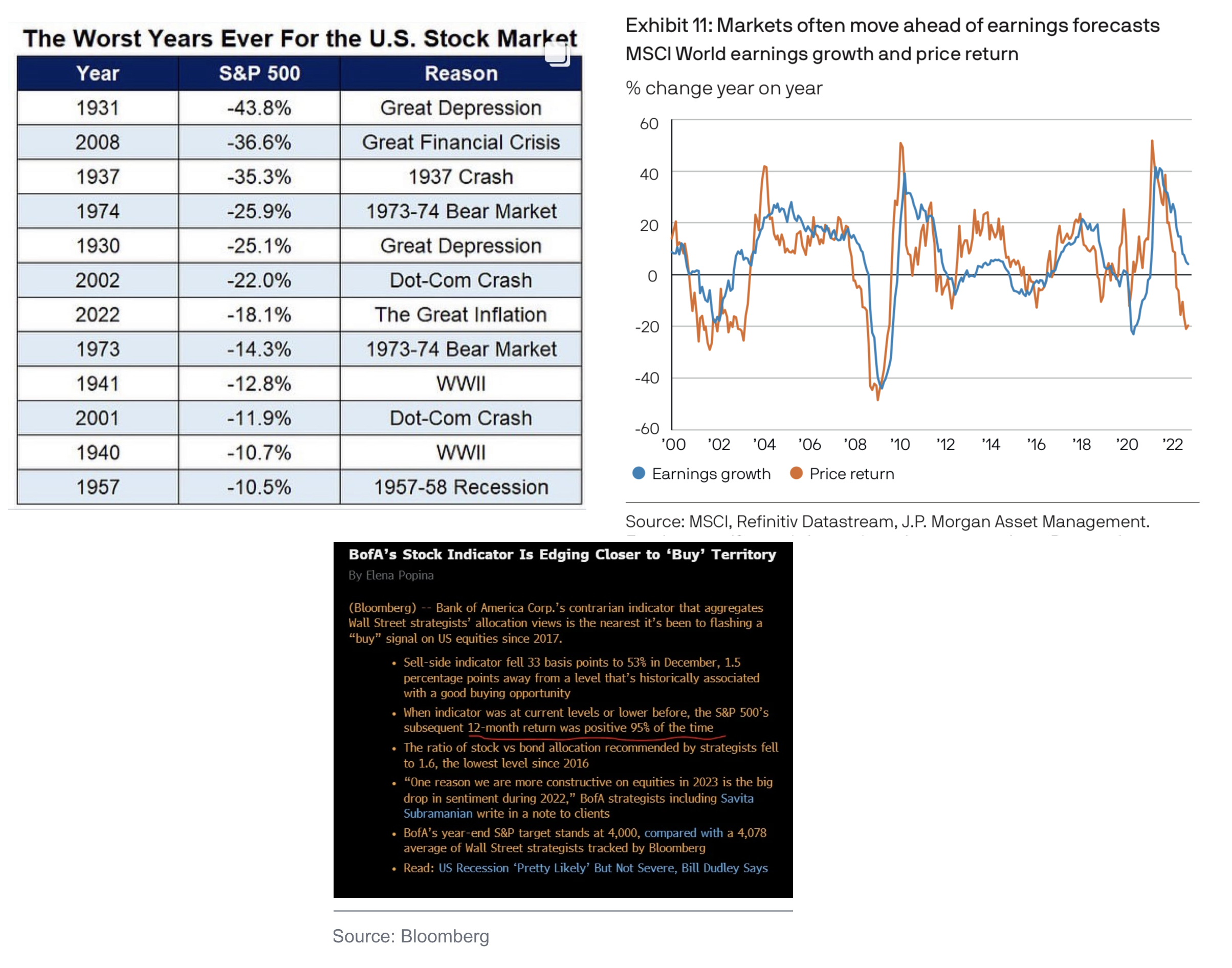

Jan 5th 2023

A recession in the next 12-18 months appears to be a foregone conclusion among economists and investors. 2022 was one of the top 10 worst years for the S&P 500 (Chart 1). But a reminder that “price leads the news” and “emotions lag price”, meaning that share prices are discounting what the market thinks is going to happen before it happens (Chart 2), and investor “emotions and sentiment” are a byproduct of how the market has performed, they are not a forecast. Sentiment is so negative that BofA’s contrarian indicator is now signaling that from these levels the market will be higher 12 months out 95% of the time.

We are here to help

We’d love to sit down and talk. Contact us for a confidential consultation:

Connect with the Team

Sheldon Le Lievre

Director, Vice President, Senior Investment Advisor