INVESTMENT BANKING

FOR PUBLICLY LISTED COMPANIES

Trusted Partners

Our Investment Banking Team looks to partner with top-tier management teams to help them lever the Canadian public markets to create shareholder value. We commit capital and resources to the best growth companies in Canada to support their pursuit of success.

Equity Underwriting

We structure transactions to provide accretive growth & acquisition capital for our corporate clients. Our in-depth knowledge of the small-cap sector combined with deep relationships in our Canadian institutional and retail investor base result in timely and successful capital raises for our corporate and investing clients.

Financial Advisory Services

Acumen supports our corporate clients with pertinent financial advice both during a transaction, and on a daily basis. Complemented by a leading institutional equity trade desk and a highly regarded equity research team, our Investment Banking Team provides strategic insight to the Canadian capital markets. Our Investment Banking Team has deep experience with Buy and Sell-Side M&A Advice, Fairness Opinions, Valuations and Initial Public Offerings.

Long Term Partners

When Acumen commits resources to a corporate client, it is with a long term view. We don’t chase hot sectors in the market. We seek out sustainable businesses run by great management teams that are stewards and compounders of our client’s capital. The following case studies are a sample of the long term relationships we are very proud of at our firm.

Recent Assignments

Adentra Inc.

Acted as co-underwriter in an ≈ $100,000,000 offering of common shares. – closed June 2024. Adentra distributes architectural products to fabricators, home centers, and professional dealers.

Evans Hunt Group

Acted as Advisor to Evans Hunt Group on the sale to a private buyer – closed May 2024. Evans Hunt is a design agency with expertise in marketing, strategy, branding, site development and more.

Enterprise Group, Inc.

Acted as Underwriter in a $7,000,000 offering of units – closed March 2024. Enterprise is a consolidator of services-including specialized equipment rental to the energy/resource sector.

Coelacanth Energy Inc.

Acted as Co-Underwriter in a $80,000,000 bought deal offering of convertible debentures – closed Nov 2023. Coelacanth is an oil and gas exploration and development company.

Surge Energy Inc

Acted as Co-Underwriter in a $48,300,000 bought deal offering of convertible debentures – closed Oct 2023.

Yangarra Resources Inc.

Acted as Underwriter in a $17,250,258 Short-Form Prospectus Offering of CDE Flow-Through Common Shares- closed March 2023. Yangarra is a company that focuses on exploration, development, and production of clean natural gas and conventional oil in western Canada.

Senior Life Settlements Public Fund LP

Acted as Sole Agent in a $3,500,000USD Private Placement Offering of Units – closed January 2023. The Fund will participate in a pool of diversified senior United States life insurance policies.

Vecima Networks Inc.

Acted as Co-Underwriter in a $17,002,370 LIFE and Private Placement Offering of Common Shares – closed December 2022. Vecima helps their customers evolve their networks with cloud-based solutions that deliver ground-breaking speed, superior video quality, and exciting new services to their subscribers.

Black Diamond Group Limited

Acted as Advisor to Black Diamond Group Limited on their strategic acquisition of an Ontario based modular rental company for $54.5 million – closed October 2022. Black Diamond is a specialty rentals and industrial services company with two operating business units – Modular Space Solutions (MSS) and Workforce Solutions (WFS).

Stampede Drilling Inc.

Acted as Co-Underwriter in a $26,624,640 Short-Form Prospectus Offering of Common Shares – closed August 2022. The goal of Stampede Drilling is to provide the safest and most efficient drilling services. High quality equipment and experienced field staff provide the foundation for Stampede Drilling to be a leader in the oil & gas industry.

Premier Health of America Inc.

Acted as Advisor to Premier Health of America Inc. on the acquisition of Canadian Health Care Agency – closed April 2022. Premier Health is a leading Canadian Healthtech company that provides a comprehensive range of outsourced services solutions for healthcare needs to governments, corporations, and individuals.

Journey Energy Inc.

Acted as Sole Underwriter in a $12,121,000 Short-Form Prospectus Offering of CDE Flow-Through Common Shares- closed March 2022. Journey is a Canadian exploration and production company focused on oil-weighted operations in western Canada.

AutoCanada Inc.

Acted as Co-Underwriter in a $350,000,000 Private Placement Offering of Senior Notes – closed February 2022. AutoCanada is a leading North American multi-location automobile dealership group operating 78 franchised dealerships, comprised of 28 brands.

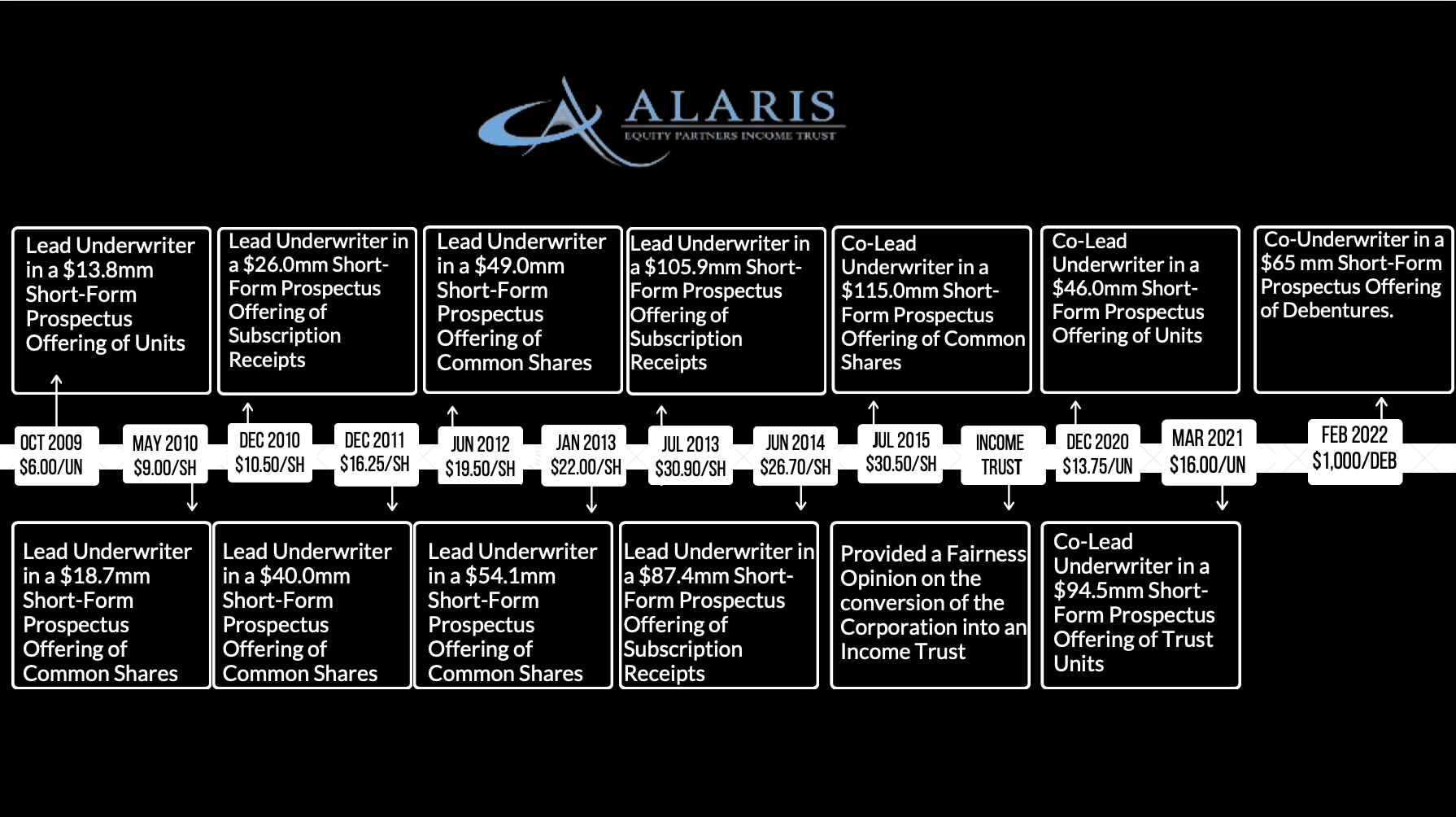

Alaris Equity Partners Income Trust

Acted as Co-Underwriter in a $65,000,000 Short-Form Prospectus Offering of Senior Unsecured Debentures – closed February 2022. Alaris, through its subsidiaries, provides alternative financing to private companies in exchange for distributions, dividends and interest with the principal objective of generating stable and predictable cash flows for dividend payments to its unitholders.

Redishred Capital Corp.

Acted as Co-Lead Underwriter in a $8,627,300 Base Shelf Prospectus Offering of Common Shares – closed December 2021. Redishred Capital Corp. is the owner of the PROSHRED® trademarks and intellectual property in the United States and Internationally. PROSHRED® shreds and recycles confidential documents and proprietary materials for thousands of customers in the United States in all industry sectors.

InPlay Oil Corp

Acted as Co-Underwriter in a $11,509,200 Short-Form Prospectus Offering of Subscription Receipts- closed October 2021.

Park Lawn Corporation

Acted as Co-Underwriter in a $148,548,400 Short-Form Prospectus Offering of Common Shares – closed September 2021. Park Lawn provides goods and services associated with the disposition and memorialization of human remains. Products and services are sold on a pre-planned basis (pre-need) or at the time of a death (at-need). Park Lawn and its subsidiaries own and operate businesses including cemeteries, crematoria, funeral homes, chapels, planning offices and a transfer service.

Tidewater Renewables Ltd.

Acted as Co-Underwriter in a $161,025,000 Initial Public Offering of Common Shares – closed August/September 2021. Tidewater Renewables has been formed to become a multi-faceted, energy transition company. The company intends to focus on the production of low carbon fuels, including renewable diesel, renewable hydrogen and renewable natural gas, as well as carbon capture through future initiatives.

Surge Energy Inc.

Acted as Co-Underwriter in a $23,001,150 Short-Form Prospectus Offering of Flow-Through Shares- closed May 2021.

Inner Spirit Holdings Ltd.

Acted as Co-Underwriter in a $11,501,840 Short-Form Prospectus Offering of Units – closed March 2021. Inner Spirit Holdings is a franchisor and operator of Spiritleaf recreational cannabis stores across Canada.

Points International Ltd.

Acted as Lead Underwriter in a $31,640,812 Short-Form Prospectus Offering of Common Shares – closed March 2021. Points is a trusted partner to the world’s leading loyalty programs, leveraging its unique Loyalty Commerce Platform to build, power, and grow a network of ways members can get and use their favourite loyalty currency.

Pollard Banknote Limited

Acted as Lead Underwriter in a $35,403,910 Short-Form Prospectus Offering of Common Shares – closed March 2021. Pollard Banknote is a leading lottery partner to more than 60 lotteries worldwide, providing high quality instant ticket products, licensed games, Schafer Systems and Fastrak retail merchandising solutions, and a full suite of digital offerings, ranging from world-class mkodo game apps to comprehensive player engagement and iLottery solutions, including strategic marketing and management services.

Premier Health of America Inc.

Acted as Sole Underwriter in a $7,486,500 Short-Form Prospectus Offering of Common Shares – closed February 2021. Premier Health is a leading Canadian Healthtech company that provides a comprehensive range of outsourced services solutions for healthcare needs to governments, corporations, and individuals.

VIQ Solutions, Inc.

Acted as Co-Underwriter in a $20,000,075 Short-Form Prospectus Offering of Common Shares – closed November 2020. VIQ Solutions is a global provider of secure, AI-driven, digital voice and video capture technology and transcription services.

IBI Group Inc

Acted as Co-Underwriter in a $46,000,000 Short-Form Prospectus and Private Placement Offering of Debentures – closed October 2020. IBI Group is a technology-driven design firm with global architecture, engineering, planning, and technology expertise spanning over 60 offices and 2,700 professionals around the world.

Alaris Equity Partners Income Trust

Acumen Capital provided a Fairness Opinion to the Board of Director. Alaris converted from a corporation to an income trust. – July 2020.

Sangoma Technologies Corporation

Acted as Co-Underwriter in a $80,513,800 Shelf Prospectus Offering of Common Shares – closed July 2020. Sangoma Technologies is a trusted leader in delivering Unified Communications and Unified Communications as a Service (UCaaS) solutions for SMBs, Enterprises, OEMs, Carriers and service providers.

Calian Group Ltd.

Acted as Co-Underwriter in a $69,018,400 Shelf Prospectus Offering of Common Shares – closed February 2020. Calian sells its diverse services through four segments: Advanced Technologies, Health, Learning, and Information Technology, which support a wide array of industry, public, and government related contracts.

H2O Innovation Inc.

Acted as Co-Underwriter in a $22,031,750 Short-Form Prospectus Offering of Subscription Receipts – closed November 2019. H2O is a leader in customized water and wastewater treatment solutions using membrane technologies. H2O designs, fabricates, and operates integrated water treatment systems for municipal, industrial, and commercial users.

Black Diamond Group

Acumen acted as a Financial Advisor to Black Diamond Group in the acquisition of Aero Travel Ltd for an undisclosed amount. Closed October 2019.

Diamond Estates Wine & Spirits Inc.

Acted as Co-Agent in a $2,324,423 Private Placement Offering of Common Shares – closed October 2019. Diamond Estates Wine & Spirits operates wineries in Ontario and British Columbia, and distributes wine and other alcoholic beverages through its wholly-owned subsidiary, Kirkwood Diamonds Canada.

Redishred Capital Corp.

Acted as Lead Underwriter in a $11,249,900 Private Placement of Common Shares – closed July 2019. Redishred Capital Corp is the owner of the PROSHRED® trademarks and intellectual property in the United States and Internationally. PROSHRED® shreds and recycles confidential documents and proprietary materials for thousands of customers in the United States in all industry sectors.

Alaris Royalty Corp.

Acted as Co-Underwriter in a $100,000,000 Short-Form Prospectus Offering of Convertible Unsecured Debentures – closed June 2019. Alaris provides alternative financing to a diversified group of private companies (“Private Company Partners”) in exchange for royalties or distributions from the Private Company Partners, with the principal objective of generating stable and predictable cash flows for dividend payments to its shareholders.

Tidewater Midstream and Infrastructure Ltd.

Acted as a co-underwriter in a $100,000,000 offering of convertible unsecured subordinated debentures – closed June 2024. Tidewater’s business objective is to build a diversified midstream and infrastructure company in the North American natural gas, natural gas liquids, crude oil, refined product, and renewable energy value chain.

Highwood Asset Management Ltd.

Acted as Co-Agent in a $35,000,000 bought deal offering of convertible debentures – closed Jul 2023. Highwood is an oil and gas company that focuses on exploration and production.

Blueline Oilfield Rentals

Acted as Advisor to Blueline Oilfield Rentals on the sale of Blueline to a private buyer – closed May 2023. Blueline provides top quality rental equipment for use in exploration and drilling with a primary focus on Heavy Weight Drill Pipe Rentals.

Data Communications Management Corp.

Acted as agent in a $26,121,600 Private Placement Offering of Common Shares – closed May 2023. Data Communications Management is a marketing and business communications partner that helps companies simplify the complex ways they communicate and operate.

Journey Energy Inc.

Acted as Underwriter in a $20,125,005 Short-Form Prospectus Offering of CDE Flow-Through Common Shares- closed March 2023. Journey is a Canadian exploration and production company focused on oil-weighted operations in western Canada.

Clearview Alberta Opportunity Fund (#1) LP

Acted as Sole Agent in a $3,840,000 Private Placement Offering of Units – closed December 2022 & January 2023. The Fund will take advantage of strategic opportunities arising in the Western Canadian Commercial Real Estate Market.

Surge Energy Inc.

Acted as Co-Underwriter in a $80,504,600 Short-Form Prospectus Offering of Common Shares- closed November 2022.

Tidewater Midstream and Infrastructure Ltd.

Acted as Co-Underwriter in a $58,070,400 Short-Form Prospectus Offering of Units – closed August 2022. Tidewater’s business objective is to build a diversified midstream and infrastructure company in the North American natural gas, natural gas liquids, crude oil, refined product, and renewable energy value chain.

Cathedral Energy Services Ltd.

Acted as Lead Underwriter in a $26,450,690 Short-Form Prospectus Offering of Units – closed April 2022. Cathedral is a trusted partner to North American energy companies requiring high performance directional drilling services.

Source Rock Royalties Ltd.

Acted as Co-Lead Underwriter in a $13,800,690 IPO of Units- closed March 2022. Source Rock is a pure-play oil and gas royalty company with an existing, light oil focused portfolio of royalty interests concentrated in southeast Saskatchewan, east-central Alberta, west-central Alberta and west-central Saskatchewan.

Goodfood Market Corp.

Acted as Co-Underwriter in a $30,000,000 Short-Form Prospectus Offering of Convertible Unsecured Debentures – closed February 2022. Goodfood is a leading online grocery company in Canada, delivering fresh meal solutions and grocery items that make it easy for customers from across Canada to enjoy delicious meals at home every day.

Hardwoods Distribution Inc.

Acted as Co-Underwriter in a $100,628,910 Short-Form Prospectus Offering of Common Shares – closed December 2021. Hardwoods Distribution is one of North America’s largest suppliers of specialty building products to fabricators, home centers and builders servicing the new residential, repair and remodel, and commercial construction end-markets. The company operates a network in North America of 83 distribution facilities in the United States and Canada .

Freehold Royalties Ltd.

Acted as an underwriter in a $172,556,350 Short-Form Prospectus Offering of Subscription Receipts – closed September 2021.

mdf commerce inc.

Acted as Co-Underwriter in a $67,800,000 Short-Form Prospectus Offering of Subscription Receipts – closed August 2021. mdf commerce enables the flow of commerce by providing a broad set of SaaS solutions that optimize and accelerate commercial interactions between buyers and sellers.

AutoCanada Inc.

Acted as Co-Underwriter in a $125,000,000 Private Placement of Notes – closed April 2021. AutoCanada is a leading North American multilocation automobile dealership group currently operating 66 franchised dealerships, comprising 27 brands, in eight provinces in Canada as well as a group in Illinois, United States.

Leucrotta Exploration Inc.

Acted as an underwriter in a $33,000,088 Short-Form Prospectus Offering of Units – closed March 2021.

Calian Group Ltd.

Acted as Co-Lead Underwriter in a $79,739,000 Base-Shelf Prospectus Offering of Common Shares – closed March 2021. Calian employs over 4,500 people in its delivery of diverse products and solutions for private sector, government and defence customers in North American and global markets. The company’s diverse capabilities are delivered through: Advanced Technologies, Health, Learning, and IT and Cyber Solutions.

mdf commerce inc.

Acted as Co-Underwriter in a $80,000,009 Short-Form Prospectus Offering of Common Shares – closed March 2021. mdf commerce enables the flow of commerce by providing a broad set of SaaS solutions that optimize and accelerate commercial interactions between buyers and sellers.

Alaris Equity Partners Income Trust

Acted as Co-Lead Underwriter in a $94,550,000 Short-Form Prospectus Offering of Trust Units – closed March 2021. Alaris, through its subsidiaries, provides alternative financing to private companies in exchange for distributions with the principal objective of generating stable and predictable cash flows for distribution payments to its unitholders.

Cargojet Inc.

Acted as Co-Underwriter in a $365,403,875 Short-Form Prospectus Offering of Common Shares – closed February 2021. Cargojet is leading provider of time sensitive premium air cargo services to all major cities across North America.

Alaris Equity Partners Income Trust

Acted as Co-Lead Underwriter in a $46,014,375 Short-Form Prospectus Offering of Trust Units – closed December 2020. Alaris, through its subsidiaries, provides alternative financing to private companies in exchange for distributions with the principal objective of generating stable and predictable cash flows for distribution payments to its unitholders.

Goodfood Market Corp.

Acted as Co-Underwriter in a $40,270,010 Short-Form Prospectus Offering of Common Shares – closed August 2020. Goodfood is a leading online grocery company in Canada, delivering fresh meal solutions and grocery items that make it easy for members from coast to coast to enjoy delicious meals at home every week.

Park Lawn Corp.

Acted as Co-Underwriter in a $75,000,000 Short-Form Prospectus Offering of Debentures – closed July 2020. Park Lawn Corporation operates in five Canadian provinces and fifteen U.S. states and owns and operates businesses including cemeteries, crematoria, funeral homes, chapels, planning offices and a transfer service.

Mediagrif Interactive Technologies Inc

Acted as Co-Underwriter in a $16,000,001 Private Placement Offering of Common Shares – closed May 2020. Mediagrif is a provider of e-commerce hosted computer technology, providing dedicated web platforms to specific business sectors that allow for the typical interactions of buyers and sellers – source, purchase or sell products and exchange information.

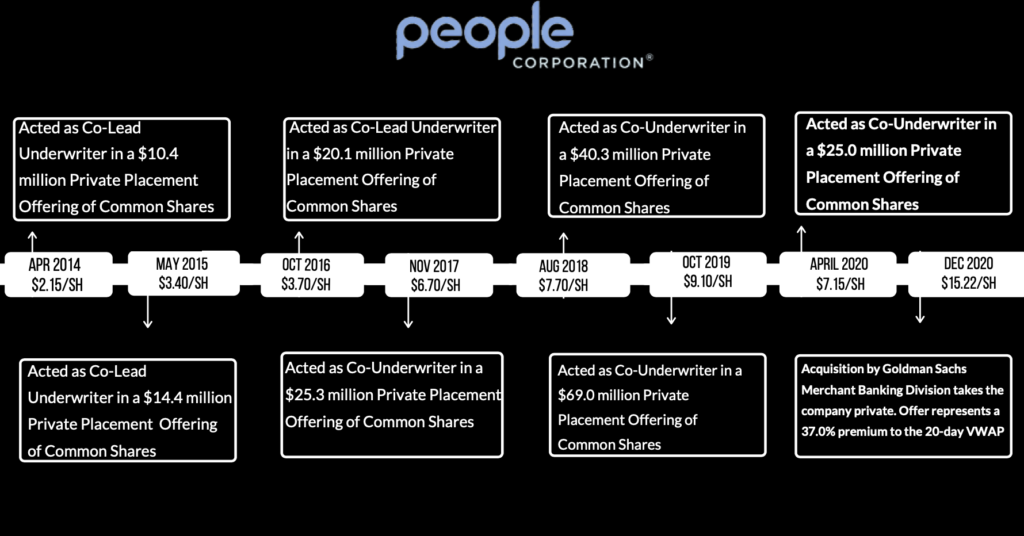

People Corporation

Acted as Co-Underwriter in a $23,006,555 Private Placement Offering of Common Shares – closed April 2020. People Corporation is a national provider of group benefits, group retirement and human resource services.

People Corporation

Common Shares – closed October 2019. People Corporation is a national provider of group benefits, group retirement and human resource services.

Sangoma Technologies Corporation

Acted as Co-Lead Underwriter in a $23,012,075 Short-Form Prospectus Offering of Common Shares – closed July 2019. Sangoma Technologies is a trusted leader in delivering Unified Communications solutions for SMBs, Enterprises, OEMs, Carriers and service providers.

Park Lawn Corporation

Acted as Co-Underwriter in a $143,770,815 Short-Form Prospectus Offering of Common Shares – closed April 2019. Park Lawn Corporation is a Canada-based corporation which owns and operates cemeteries, crematoriums, and funeral homes in the Greater Toronto Area, Ottawa, Western Quebec, Manitoba, Saskatchewan, Illinois, Kansas, Kentucky, Michigan, Mississippi, Missouri, New Mexico and Texas (USA).

Cargojet Inc.

Acted as Co-Underwriter in a $115,000,000 Short-Form Prospectus Offering of Hybrid Debentures – closed April 2019. Cargojet is the dominant provider of time-sensitive overnight air cargo services in Canada with over 90% market share. The Company’s fleet of short-and long-range aircraft operate its core domestic network and provide a platform to gain market share in the international air cargo market.

Goodfood Market Corp.

Acted as Co-Underwriter in a $26,334,053 Short-Form Prospectus Offering of Common Shares – closed February 2019. Goodfood is the leading home meal solutions company in Canada. The company delivers ingredients to its subscribers weekly to prepare meals at home. The company has its main production and head offices in Montreal with a second production facility in Calgary. It began operations in 2014 in Quebec as Culiniste and began trading on the TSX in June 2017.

Inner Spirit Holdings Ltd.

Acted as Co-Lead Agent in a $10,000,000 Short-Form Prospectus Offering of Units – closed May and June 2019. Inner Spirit Holdings Ltd. is applying a successful franchise and retail model to the recreational cannabis industry. With a group of over 100 franchise partners, corporate retail cannabis locations being built out, and a proprietary brand portfolio under various stages of development, Inner Spirit Holdings Ltd. is positioned to be an industry leader.

North American Construction Group Ltd.

Acted as Co-Underwriter in a $55,000,000 Short-Form Prospectus Offering of Convertible Unsecured Debentures – closed March 2019. North American Construction Group is one of Canada’s largest providers of heavy construction and mining services.